The AI Gold Rush Is Over: VCs Still Chasing Yesterday's Wins

- Brado Greene

- Aug 10, 2025

- 2 min read

Updated: Aug 31, 2025

The venture capital world is in the midst of an AI gold rush, but are investors digging in the right places? A closer look at the data reveals a stark reality: much of the capital is flowing into an already-crowded landscape, overlooking a new frontier of high-potential, underserved opportunities. While the market celebrates massive funding rounds in well-known sectors, a new metric, the AI Disruption-to-Investment Index (DII)™, shows that the greatest potential for outsized returns lies elsewhere.

The DII is a simple yet powerful framework designed to cut through the hype. It systematically measures an industry's potential for AI disruption against the percentage of total AI-specific venture capital funding it receives. A high DII score signals a market inefficiency—an area with high disruption potential that is not yet saturated with capital. For investors, this is the ultimate signal for discovering "alpha."

Where the Money Is (And Isn't): Visualizing the AI Investment Gap

Our analysis, featured in the DII Report, presents a clear picture of this imbalance.

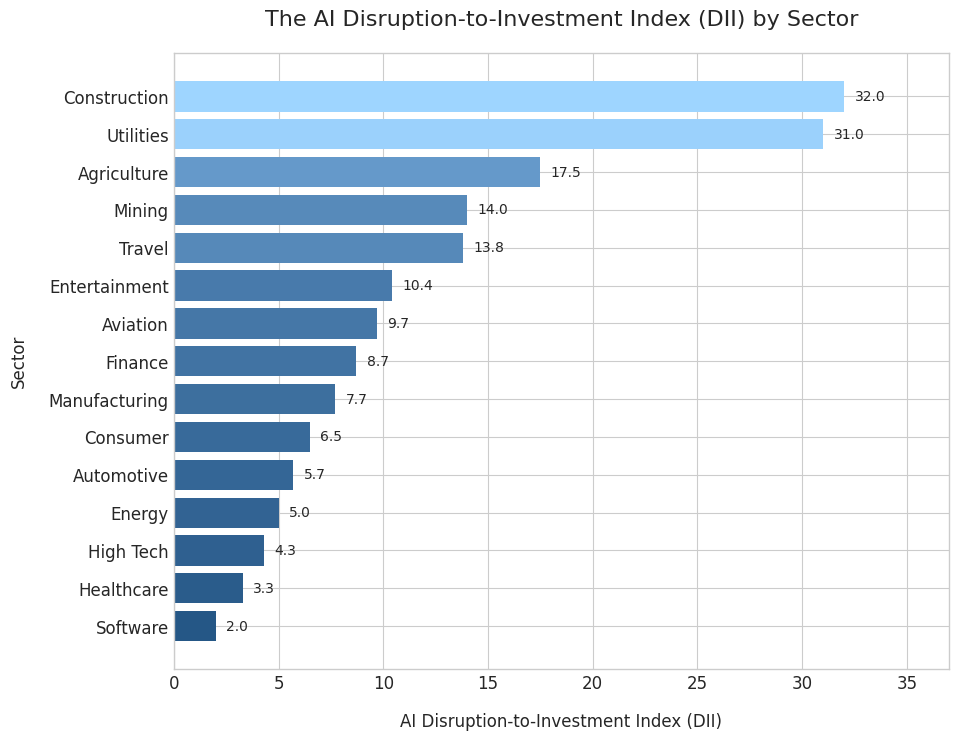

Figure 1: The AI Disruption-to-Investment Index (DII) by Sector

This chart powerfully demonstrates that sectors with the highest DII scores are far from the traditional tech hubs. Industries like Construction, Utilities, Mining and Metals stand out with massive DII scores, indicating a significant disparity between their high potential for AI-driven transformation and their low levels of current VC funding. This is the Venture Frontier, a space where a strategic investment today could yield significant returns as AI technologies are applied to solve fundamental, long-standing problems.

Conversely, the same report shows why some of the most celebrated sectors, such as Software and Healthcare, have much lower DII scores. While their disruption potential is high, they are also highly competitive and well-funded, making it challenging to achieve the kind of exponential returns that define early-stage venture capital.

Figure 2: The AI Investment Landscape: A Scatter Plot of Disruption Potential and VC Funding

The scatter plot further illustrates the AI investment landscape, mapping sectors based on their AI exposure and current VC funding levels. Interestingly, the most underserved industries, as indicated by the highest DII scores and low funding, are predominantly located in the bottom-left quadrant. This signifies sectors such as Construction and Utilities, which possess significant potential for AI-driven efficiencies and a high Disruption-to-Investment Index, but currently receive minimal venture capital investment.

Gaining a Competitive Advantage

In a market where everyone is chasing the same deals, a data-driven approach to identifying underserved sectors is the key to gaining a competitive advantage. The DII metric provides a strategic lens to do just that. It allows investors to:

Diversify their portfolio into industries that are ripe for AI disruption but have been largely ignored.

Generate outsized returns by getting in early on deals before they become part of the crowded "AI gold rush."

Become a pioneer in a new wave of innovation, focusing on foundational industries where AI can deliver truly transformative impact.

For a deeper dive into our full analysis, including the data and methodology behind the DII, access the full report here: AI Disruption-to-Investment Index (DII)™ Full Report

In a world where the consensus is often wrong, the DII metric gives you the data to make a contrarian bet, and win!

.png)